Last updated

Solving payout problems

A payout is the part of the payment process where the price of an order is paid to the provider's bank account. This article gives you an overview of what problems you may encounter with payouts in Sharetribe and how to solve those problems.

Table of Contents

Introduction

Enabling customers to pay for their orders and paying that money to listing providers is one of the most valuable features of Sharetribe. Most of the time payments work as expected: the customer pays for the order, and the provider receives the money when it's time. However, there are many variables that affect the payments and sometimes problems may occur. The payment gateway can deny payouts to a user, the user's bank might deny payouts, or for some other reason the numbers don't seem to add up. This article presents potential cases where payouts might fail and what are the ways to fix those issues.

Payments in Sharetribe

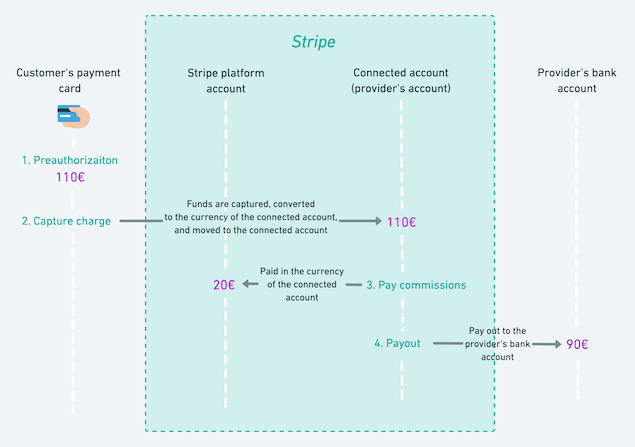

To make sure that payments make it to the provider and that the marketplace operator can collect their commissions, Sharetribe uses a payment gateway called Stripe. The image above presents the steps that are taken when a customer pays for an order and the money is eventually paid to the provider. As an example, it uses a booking that costs 100€ and has both customer and provider commissions of 10%. The different entities that are involved in the process are Customer's payment card, Stripe platform account, Connected account, and Provider's bank account.

- Customer's payment card Credit or debit card that the customer uses to pay for the booking.

- Platform account Stripe account of the marketplace. This is the account that is identified by the secret Stripe key that is configured in the Console.

- Connected account Provider's connected account in Stripe. This account is created by Sharetribe and it is not accessible by the provider but it can be used to specify the payouts of a single provider in the Stripe Dashboard.

- Provider's bank account This is where the money is paid when a payout is created.

The different steps where money moves around in the payment process are as follows.

- Preauthorize An amount of money is preauthorized from the customer. The amount of the transaction does not leave customer's payment card but it's reserved to pay the booking. In the default transaction process this happens when a customer requests to book a listing and the payment is confirmed.

- Capture charge Sharetribe operates using a Stripe concept called PaymentIntents but behind the scenes a charge is what defines the payment. When a charge is captured, the preauthorization from step 1. is paid to Stripe and more specifically to the connected account of the provider. Once money is transferred to a connected account it is converted to a settlement currency which is the currency of the connected account. The settlement currency is defined by the currency of the associated bank account. At this point the provider does not yet have access to the money. It stays in Stripe and is earmarked to be paid to the provider. In the default processes this happens when the provider accepts a booking request, or the customer purchases a product. See also the background article on PaymentIntents in Sharetribe and the payments overview.

- Pay commissions Once a charge is captured and the money is in the provider's connected account, commissions are moved to the marketplaces Stripe account (the platform account). In our case both customer and provider commissions are 10€.

- Payout In the payout money from the connected account is paid to the provider's bank account according to the payout details they have provided.

Normally everything goes as expected, but as payments involve multiple 3rd party stakeholders there are some cases where for one reason or another the payout fails. In these cases it's good to know a few places where to look into to solve the situation.

Why payouts fail

Insufficient funds

Payouts can fail if the provider's connected account does not hold enough funds to pay out a charge. Here are a few scenarios in which a connected account can have insufficient funds.

Manual refund

Manually refunding a payment straight from Stripe usually fixes the transaction that is being refunded but it may lead to problems in forthcoming transactions. Therefore, you should never manually refund payments in the Stripe Dashboard!

As an example of how manual refunds can result in insufficient funds on a connected account, picture the following scenario:

- Provider has two transactions, both have a captured charge.

- Price on both is the same as in the image above: the booking costs 100€, customer and provider commissions are both 10%.

- The balance on the connected account is therefore 180€.

Now the provider decides to cancel one of the bookings while the transaction is in a state where cancelling is not permitted by the transaction process. In order to solve the situation, the operator decides to refund the payment manually from Stripe. As the provider was late to cancel the booking, the operator decides to keep both commissions and let the provider pay them. The following takes place:

- The operator refunds the payment manually from Stripe, selecting not to refund the application fee (the commissions in Stripe terms).

- 110€ is refunded from the provider's account, leaving the balance there to 70€.

- Eventually it's time to pay out the other transaction. The balance of 70€ is insufficient for paying out 90€ to the provider's bank account and the payout for that transaction will fail.

Manual refunds are not supported by Sharetribe. Ideally the transaction process should be designed so that all refunds can be performed from Sharetribe.

Disputes

Dispute is an act where a customer announces to their payment instrument provider that a payment has not been valid and wishes the paid amount to be returned to them. This will cause the payment being debited to the platform account with an additional chargeback fee that varies between countries. The platform account is responsible for all disputed payments but it can also debit the connected account for the disputed payment if it appears to actually be fraudulent. This is done by reversing a transfer manually from Stripe.

When a transfer is reversed, funds are moved from a connected account to the platform account. If a transaction is already paid out from the connected account this can lead to a negative balance. In some countries Stripe can withdraw funds from a bank account associated with a connected account in order to cover a negative balance. In countries where this is not supported negative or insufficient funds caused by disputes can cause forthcoming payouts to fail.

The payout is too small

Stripe refuses to make a payout sometimes if the amount is too small. The minimum payout varies depending on the settlement currency (currency of the connected account). More about payout limits can be found in the Stripe documentation. This is quite a rare problem as there is also a minimum amount for creating a charge so smaller payments usually fail already at that phase. But still good to keep in mind when investigating a failing payout.

Stripe or bank refuses the payment

Sometimes Stripe or the provider's bank can refuse a payment for varying reasons. In most cases it's due to some information being missing from the provider's connected Stripe account. At the moment Sharetribe can not keep up with payout status changes like this so if Stripe or the receiving bank refuses the payout for one reason or another, the transaction state in Sharetribe will not update.

How to investigate and fix failed payouts

Insufficient funds

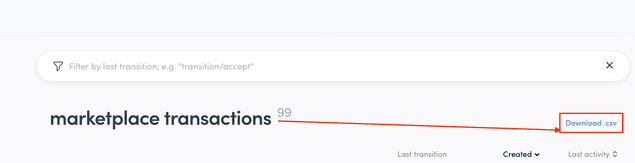

If there's a reason to doubt that a payout has failed, one place to start tracking it is the transactions CSV export which is available under Manage > Transactions in Console.

The transactions CSV file has a column called PayoutState which indicates what is the status of the payout. PayoutState can have five different values.

- Pending. This means that the customer has been charged, but your marketplace has not yet attempted to initiate a payout to the provider.

- Due. This means that a date for the payout has been assigned by Sharetribe. You can see this date in the column PayoutDue. Sharetribe will attempt a payout on this date.

- Paid. Sharetribe has attempted to pay the money to the bank account of the provider. According to Stripe, it will then take between 1 and 7 days for the money to reach their bank account. However, it's still possible for the payout to fail, if there's something wrong with the account of the provider.

- Cancelled. This means that the payout won't be attempted, because the transaction was cancelled for one reason or another (by you, the customer, or the provider), and the money has been refunded to the customer.

- Failed. This means that something went wrong with the payout, and the provider didn't receive the money they were supposed to receive.

Another column to pay attention to in the CSV file is PayoutTotalConverted. It is the payout total (in subunits) converted to the settlement currency of the connected account. This amount of money should be available in the connected account in order to successfully pay out the charge.

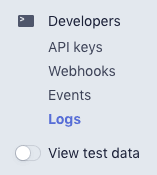

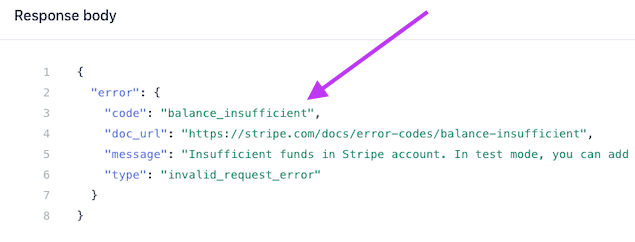

If failed payouts are found in the transactions CSV export, the next step is to identify the corresponding failed payout events from Stripe. Log into the Stripe Dashboard and look for the Logs tab under Developers.

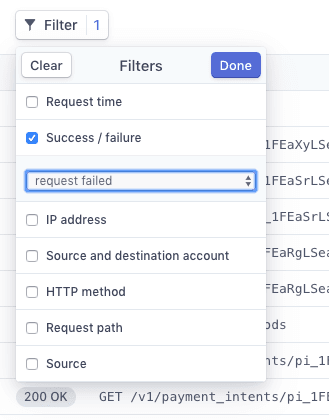

From the logs clear all other filters but request failed.

Now see if there are any POST requests with status 400 ERR to the

/v1/payouts endpoint. If found, open the request and see if the error

code is balance_insufficient.

If an error with the balance_insufficient code is found it can be

matched to the transactions in the CSV export by checking the

sharetribe-transaction-id field from the Request POST body section

of the request and comparing that to the Id field in the CSV file. By

comparing the balance of the associated connected account to the

PayoutTotalConverted of the transaction in the CSV it's possible to

find out what is the missing amount of money. The missing amount can

imply why the balance is not enough to pay out the charge. For manual

refunds it's also good to take a look into the Payments of the

associated connected account in Stripe Dashboard and see if there are

any refunds found there.

In the case of insufficient balance the solution is usually to manually create the payout from Stripe Dashboard and in that payout take into account the reason what led to the lack of funds in the connected account. In the example case of manual refunds presented above the solution would be to reduce the 20€ of commissions that the provider owns from the previous transaction and manually pay out the remaining 70€ from the connected account.

The payout is too small

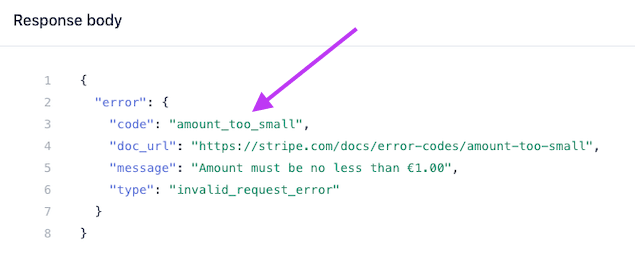

The case of a payout failing due to too small amount of money, it's good

to start with the transactions CSV export, just like in the case of

insufficient funds. Also look to the events log in Stripe Dashboard.

However, in this case the error code in the response of the failed

request is amount_too_small.

To solve the problem, wait for more transactions for the connected account and manually bundle them together and pay out at once.

Stripe or bank refuses the payments

The CSV export does not help in the case where the payout fails due to missing information. As mentioned the payout state does not propagate back to Sharetribe in cases like this. If the payout state seems to be fine but a provider is reporting missing payouts, it's good to take a look at the connected account of the user. The associated Stripe account can be found in Console from the user view. Usually the problem is missing the account and act based on those to fill in missing information. information in the connected account. See if there are any warnings in